Equity futures are down this morning with massive intervention in Japan affecting the currency markets while people around the globe come to realize that Europe is simply running a circular Ponzi scheme to hide their insolvency (same as in the U.S.) – and that as a basis of a stock market rally means “sold to you” distribution is occurring, those buying in now will be striped of their “assets” later. Hey, you’ve been told you’re playing in manipulated markets, if you haven’t withdrawn from their hologram yet, don’t come crying later – you’ve definitely been tricked.

The dollar is up as the Yen falls massively from record highs, bonds are higher, oil is lower, gold & silver are lower, and food commodities are slightly lower as well.

The Chicago PMI for the month of October came in this morning at 58.4 which is below September’s 60.4 reading and close to consensus. Econofool makes a big deal that this index value is above the “expansion” level of 50 – just remember WHO it is that makes these indices and the self-interest involved in pumping on both the “Fed’s” part and on the part of Econodrool:

Highlights

Very strong rates of monthly expansion in the Chicago area extended through October. The Chicago purchasing managers composite index came in at 58.4, well above 50 to indicate monthly expansion in general business activity though at a slightly less robust pace than September's 60.4 level. But October's 58.4 reading, which is four tenths above the Econoday consensus, is impressive and is right at the four-month average of 58.5.

Orders are the most important components and point to very strong production and employment in the months ahead as businesses expand capacity. New orders came in at 61.3, showing monthly expansion against September's outsized 65.3 for one of the strongest monthly rates of expansion of the last six month. Backlog orders rose nearly six points to 51.2 to show a monthly build and to end two months of draws.

Employment is another highlight of October, accelerating 1.7 points to 62.3. Production is also very strong at 63.4. Other readings include a slowing in inventory accumulation, one hinting at a production-related draw, and also include a slowing in supplier deliveries which is consistent with increasing traffic in the supply chain. Prices paid accelerated which is also consistent with strong activity.

The sample of the Chicago report includes businesses from all areas of the economy and continues to show exceptionally healthy conditions. Regional manufacturing reports from the district Federal Reserves have been mixed this month, with some showing a bounce back for expansion but others continuing to show contraction. Stocks are showing no significant early reaction but today's report may help raise confidence for strength in the two ISM reports this week and may help limit losses through the session. The Dallas manufacturing survey will be posted today at 10:30 a.m. ET.

Remember that most of these indices are first measured in dollar values, then turned into an index, and “adjusted” by the very same people whose living depends upon keeping the central banker box alive. My new slogan goes like this: Lying is a cooperative act. We, the 99%, no longer consent.

Everything the “Fed” does is designed to trick you. From their very name, all the way to every report they disseminate, nothing but lies, disinformation, disconnects between words and actions, and blatant self-interest all designed for them to profit at your expense. And robbing you they are. Their advertised inflation rate is running a little more than 2%, vastly understated I say. Today the University of Washington confirmed that for us in the Seattle area:

The cost for two parents and two children to live in Seattle has risen 13 percent in the last two years and for single people, it's 19 percent more expensive, according to a University of Washington survey.

The Seattle P-I.com reports the study indicates it costs a single parent of two children in East King County $65,690 to meet basic needs, up 14 percent from 2009.

Hmmm, home prices are still falling (your “asset”), yet the cost for singles to live is up 19%! That’s nearly FIVE TIMES the “Fed’s” stated rate of inflation.

Speaking of inflation, guess whose houses are INflating in value like mad?

October 27 – Bloomberg (Katie Spencer): Home prices in the Hamptons, the Long Island beach towns that attract summering Manhattanites, surged 22% in the third quarter from a year earlier as demand climbed for the most expensive properties. The median price of homes sold in the quarter increased to $850,000 from $696,000 in the same period last year…

That’s the thing about inflation within the central banker box, those closest to the production of money benefit, while those further away from that production suffer.

With the current money explosion occurring, do not be surprised when real inflation surpasses 10% or more per year – of course there will be asset stripping waves of deflation mixed in, but the course of global currencies is clear. Just look at the actions Japan’s Prime Minister took last night – he said that he was going to do what it takes to force the Yen lower without stating a figure as to how much money he would create in order to accomplish that, stating instead, “I’ve repeatedly said that we’ll take bold action against speculative moves in the market.” Azumi then acted unilaterally, creating huge shifts in the global currency markets – direct manipulation.

On the daily chart of the Yen you can see the last three interventions, all of which created large moves which are accomplished by printing trillions of yen and then buying into the market:

Printing money to protect your currency is a competitive game with ever increasing numbers, forcing other central banks around the world to do likewise in order to protect their trade. The root cause of this has the very same reasons we’ve been talking about for years, it is rooted in WHO it is that controls the production of money. When giant interventions occur in currency and bond markets, there is no such thing as “free markets” anywhere.

We just learned that MF Global filed for bankruptcy this morning. For those who don’t know, Wiki describes them like this, “MF Global is a major global financial derivatives broker providing exchange-traded derivatives such as futures and options as well as over-the-counter products such as contracts for difference (CFDs), foreign exchange and spread betting. MF Global is also a primary dealer. MF Global traces its roots to the sugar trading business started by James Man in England in 1783, which evolved into broader commodities trading before its later transformation into a financial services business during the 1980s.”

And just like that, one of the major leaders in producing and controlling the production of derivatives (which act like money, a part of the “moneyness”) is in serious trouble. Gee, I’m sure there’ll be no spill-over from that… go long.

I spent this Saturday at a local Occupy rally. I can tell you that more and more people are waking up and they are all getting very close to target. Bill Still also went to his local rally and filmed his thoughts on Libertarianism, after all, he is now running on the Libertarian ticket for President:

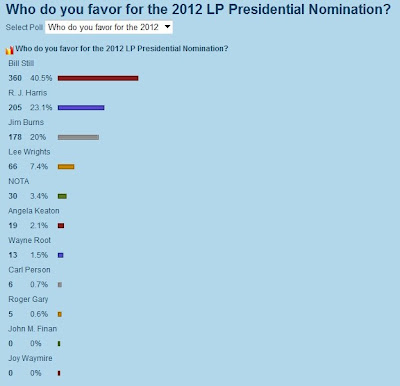

Like Bill says, please go here, register on the site, and then vote in the Libertarian straw poll. Gee, look who’s leading:

Go Bill! Voting for Bill is the only shot we have working within the system to truly shift the production of money back in favor of the people – I highly encourage you to support Bill any way you can, his website is located here: Still2012.com

Which will it be, trick or treat? Lying is a cooperative act. I, for one, no longer consent to the lies.